We're here, Monday to Friday from 9:00am - 5:00pm to help you over the phone.

Interest Rate Announcement: Following the RBA’s decision to increase the official cash rate by 0.25%, we're making some changes to our interest rates. Read more here.

We're aware of scammers claiming to be from GMCU. We will never ask you to share your online banking password, SMS one-time password, or any other personal information, over the phone.

You may receive a text message from our fraud monitoring service, VIGIL - asking you confirm via SMS whether a transaction is legitimate, or to call 1300 705 750. Click here for more information about VIGIL.

At GMCU, we take your privacy and protection seriously. That’s why we’ve implemented a comprehensive range of security measures to safeguard your personal information and online transactions. These include:

So when you bank online with us, you can feel confident knowing your information is secure.

Here are some important tips on keeping your online banking and personal information safe:

If you believe you have accidently shared information with a scammer, change your online banking password immediately if possible, and contact us as soon as you can.

SMS One-Time Passwords (OTP’s) also provide an extra layer of protection through two-factor authentication (2FA). Even if someone knows your password, they can’t access your account without the unique code sent to you via SMS. Because OTPs are:

They make it much harder for fraudsters to gain access to your account, helping to keep your money and personal information safe.

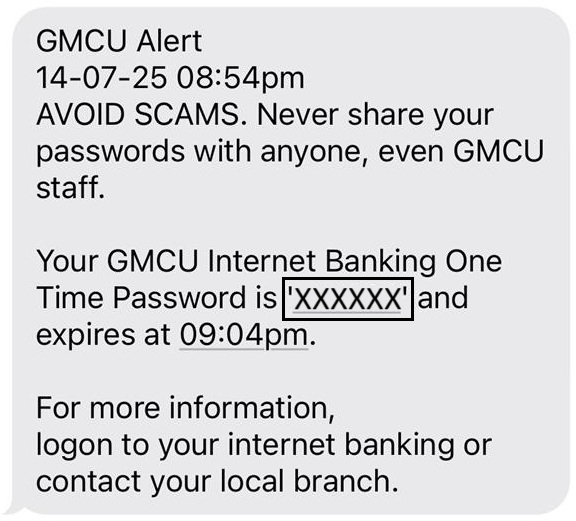

A One-Time Password (OTP) is a single use six-digit security code sent to your registered mobile phone by SMS. OTPs are commonly used as an extra layer of protection to enhance security when banking online.

You no longer need to register for OTPs - they’ll be automatically sent to the mobile number you have on file with us.

Don’t disclose this code to anyone, even GMCU staff (Tip: scammers will often impersonate bank staff to get access to your accounts).

What does the SMS One-Time Password look like?

Yes, online banking is secure when accessed through trusted platforms. We use advanced security technologies such as encryption, firewalls, and secure login processes to protect your data and transactions.

Always ensure you're accessing your account through our official website or app.

Mobile banking is protected by multiple layers of security, including:

These measures help ensure your information stays safe, even if your device is lost or stolen.

OTPs provide an extra layer of protection through two-factor authentication (2FA) within Internet Banking. Even if someone knows your password, they can’t access your account without the unique code sent to your mobile phone. Because OTPs are:

They make it much harder for fraudsters to gain access to your account, helping to keep your money and personal information safe.

If you haven’t set up OTP yet, follow these steps:

If you need assistance, please contact your local GMCU branch.

If you suspect your password has been compromised:

Never share your personal or banking details unless you're absolutely sure of the source. If you receive a suspicious call, email, or SMS:

If you're ever unsure if you're speaking to a GMCU staff member, hang up and call us on 1800 MY GMCU (1800 694 628).

We may ask you to confirm your details to:

This is safe only when done through secure channels—such as our official app, website, or when you contact us directly. If you're ever unsure, reach out to us before providing any information.

If your card is lost or stolen:

If you notice a transaction you didn’t make:

When you finish banking through the GMCU Mobile App always logout by tapping on the logout icon in the top right-hand corner of the screen. None of the information accessed through Mobile Banking will be saved on your mobile phone. Do not save your Internet Banking password anywhere on your mobile in case of loss or theft on your mobile phone.

If your phone is lost or stolen:

If you suspect any issues with your account, card, or online banking credentials, contact GMCU immediately. We’re here to help. You can also visit our website for more tips on staying safe online.

We recommend updating your password every 3–6 months. Choose a strong, unique password that includes a mix of letters, numbers, and symbols. Avoid using easily guessed information like birthdays or names.

Banking, loans, insurance and more - get in touch with us.